When it comes to managing your mortgage payments, finding a reliable and efficient service provider is crucial. RoundPoint Mortgage Pay offers a seamless solution for homeowners, providing a streamlined experience for monthly payments and financial management. With a range of options and a user-friendly interface, RoundPoint Mortgage Pay ensures that your mortgage payments are handled with ease and precision.

Understanding the intricacies of mortgage payments can often be daunting, but RoundPoint Mortgage Pay simplifies the process by offering clear, concise, and accessible payment solutions. Whether you are a first-time homeowner or someone with multiple properties, navigating the payment landscape has never been easier. This comprehensive guide will walk you through the features, benefits, and options available through RoundPoint Mortgage Pay, helping you make informed decisions for your financial future.

In today’s fast-paced world, having a reliable mortgage payment system is more important than ever. RoundPoint Mortgage Pay not only provides convenience but also offers peace of mind by ensuring your payments are made on time and accurately. By exploring the various facets of RoundPoint Mortgage Pay, you’ll discover how this service can enhance your financial management skills and support your journey toward homeownership success.

Table of Contents

- What is RoundPoint Mortgage Pay?

- Benefits of Using RoundPoint Mortgage Pay

- How to Set Up RoundPoint Mortgage Pay

- Understanding Your Mortgage Statement

- Payment Options Offered by RoundPoint

- Security Measures and Privacy

- Customer Support and Assistance

- Managing Your Mortgage Online

- RoundPoint Mobile App Features

- Understanding Interest Rates and Fees

- Tips for Efficient Mortgage Management

- Common Issues and Solutions

- Frequently Asked Questions

- External Resources

- Conclusion

What is RoundPoint Mortgage Pay?

RoundPoint Mortgage Pay is a financial service designed to simplify the process of making mortgage payments for homeowners. As an established player in the mortgage servicing industry, RoundPoint provides a variety of payment options, helping borrowers manage their accounts more effectively. Their services are tailored to meet the diverse needs of homeowners, ensuring a smooth and efficient payment experience.

At its core, RoundPoint Mortgage Pay focuses on providing clear and user-friendly solutions for mortgage payments. By utilizing cutting-edge technology and a customer-centric approach, they are able to offer a seamless experience for homeowners. Whether you prefer to make payments online, through their mobile app, or via traditional methods, RoundPoint has got you covered.

In addition to payment management, RoundPoint Mortgage Pay also offers a range of other services, including loan modification assistance and refinancing options. These services are designed to help homeowners maintain financial stability and achieve their long-term goals. By offering comprehensive mortgage solutions, RoundPoint stands out as a reliable partner for homeowners across the nation.

Benefits of Using RoundPoint Mortgage Pay

Choosing RoundPoint Mortgage Pay as your payment service provider comes with a host of benefits. One of the most significant advantages is the convenience it offers. With multiple payment options available, homeowners can select the method that best suits their lifestyle and preferences.

Another key benefit is the transparency and clarity provided by RoundPoint. Their detailed mortgage statements and easy-to-understand payment process allow homeowners to stay informed and in control of their financial obligations. Additionally, RoundPoint's commitment to customer service ensures that any questions or concerns are promptly addressed by their dedicated support team.

RoundPoint Mortgage Pay also prioritizes security, implementing robust measures to protect your financial information. By using advanced encryption technologies and secure payment gateways, they ensure that your data remains safe and confidential. This emphasis on security provides peace of mind for homeowners, knowing that their financial transactions are protected.

How to Set Up RoundPoint Mortgage Pay

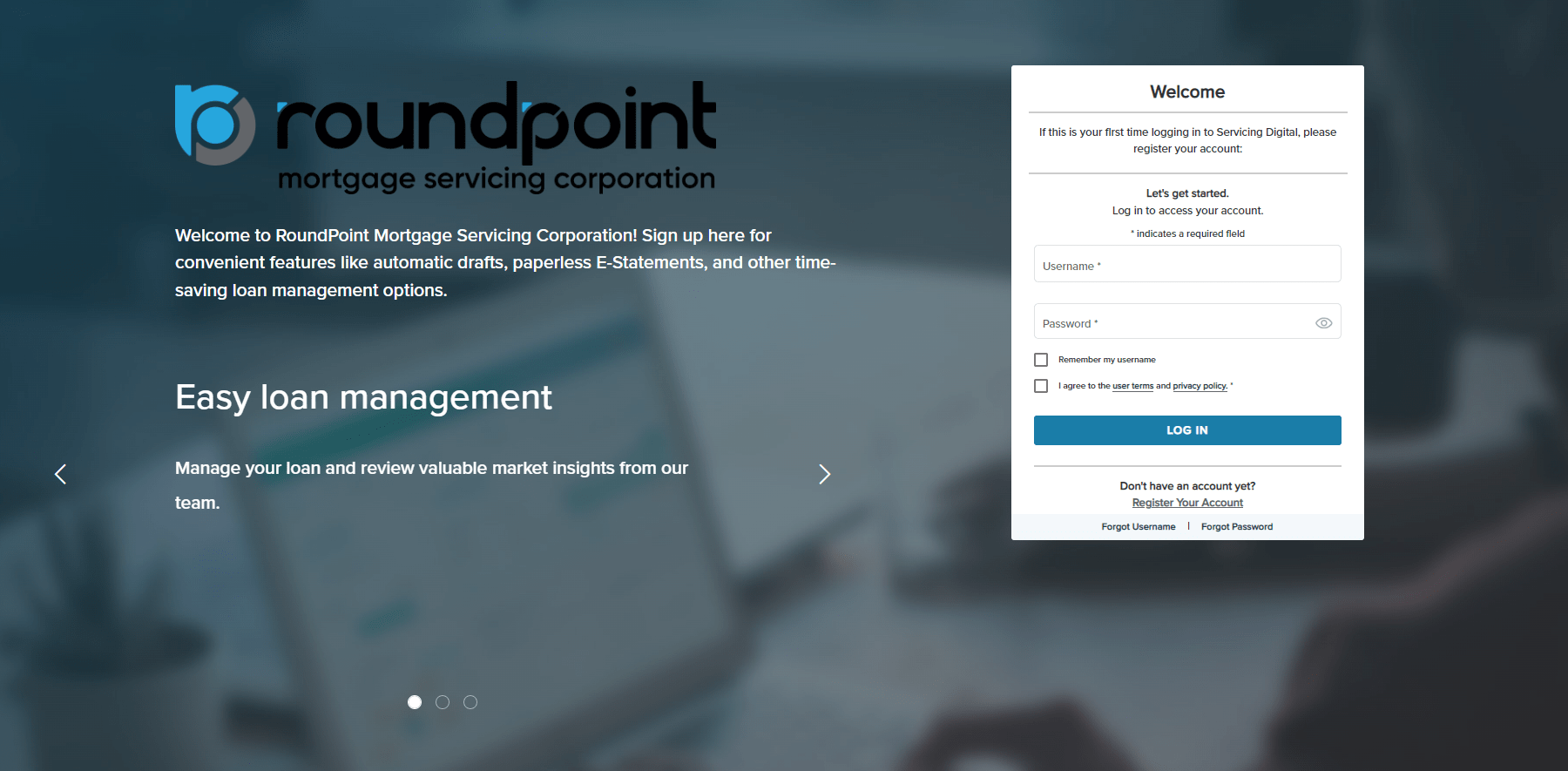

Setting up RoundPoint Mortgage Pay is a straightforward process. To get started, homeowners need to create an online account on the RoundPoint website. This account will serve as the central hub for managing mortgage payments and accessing important account information.

Once the account is created, homeowners can choose their preferred payment method. RoundPoint offers several options, including online payments, automatic bank drafts, and traditional mail-in payments. Each method comes with its own set of instructions, making it easy for homeowners to get started.

After selecting a payment method, homeowners can set up their payment schedule. Whether you prefer to make monthly payments manually or set up automatic drafts, RoundPoint provides the flexibility to choose what works best for you. This flexibility ensures that your mortgage payments align with your financial needs and goals.

Understanding Your Mortgage Statement

Your mortgage statement is a crucial document that provides detailed information about your loan and payment history. RoundPoint Mortgage Pay ensures that these statements are clear and easy to understand, helping homeowners stay informed about their financial obligations.

Each mortgage statement includes key details such as the outstanding loan balance, interest rate, and payment due date. Additionally, it provides a breakdown of how your payments are applied, including the principal, interest, and escrow components. By reviewing your mortgage statement regularly, you can ensure that your payments are accurate and up-to-date.

RoundPoint also offers resources and support to help homeowners understand their mortgage statements. Their customer service team is available to answer any questions and provide clarification on the information presented in your statement. This commitment to transparency and education empowers homeowners to manage their mortgages more effectively.

Payment Options Offered by RoundPoint

RoundPoint Mortgage Pay offers a variety of payment options to accommodate the diverse needs of homeowners. These options include online payments, automatic bank drafts, and traditional mail-in payments. Each method is designed to provide convenience and flexibility, allowing homeowners to choose the option that best fits their lifestyle.

Online payments are one of the most popular options, offering a quick and easy way to manage your mortgage. By logging into your RoundPoint account, you can make payments directly from your bank account or using a credit card. This method provides instant confirmation and allows you to track your payment history in real-time.

Automatic bank drafts are another convenient option for homeowners who prefer a hands-free approach to mortgage payments. By setting up automatic drafts, your payments will be deducted from your bank account on a regular schedule, ensuring that your mortgage is always paid on time. This method eliminates the need for manual payments and reduces the risk of late fees.

Security Measures and Privacy

RoundPoint Mortgage Pay takes the security and privacy of its customers seriously. They employ a range of security measures to protect your financial information and ensure that your transactions are safe. These measures include advanced encryption technologies, secure payment gateways, and regular security audits.

By implementing these security protocols, RoundPoint ensures that your data remains confidential and protected from unauthorized access. This commitment to security provides peace of mind for homeowners, knowing that their financial information is in safe hands.

In addition to security measures, RoundPoint also has a comprehensive privacy policy in place. This policy outlines how your personal information is collected, used, and shared, ensuring transparency and accountability. By adhering to strict privacy standards, RoundPoint demonstrates its commitment to protecting your rights and maintaining your trust.

Customer Support and Assistance

RoundPoint Mortgage Pay prides itself on providing exceptional customer support and assistance. Their dedicated team of professionals is available to answer any questions and address any concerns you may have about your mortgage payments.

Whether you need help understanding your mortgage statement, setting up a payment method, or resolving a payment issue, RoundPoint's customer service team is ready to assist. They offer support through various channels, including phone, email, and online chat, ensuring that you have access to the help you need when you need it.

RoundPoint's commitment to customer service extends beyond resolving issues. They also offer educational resources and tools to help homeowners better understand their mortgages and manage their finances. By providing comprehensive support and assistance, RoundPoint empowers homeowners to take control of their financial future.

Managing Your Mortgage Online

With RoundPoint Mortgage Pay, managing your mortgage online has never been easier. Their user-friendly website and mobile app provide all the tools you need to stay on top of your mortgage payments and account information.

By logging into your RoundPoint account, you can view your payment history, check your outstanding balance, and update your personal information. You can also make payments, set up automatic drafts, and access important documents, all from the convenience of your computer or mobile device.

RoundPoint's online management tools are designed to provide a seamless and efficient experience for homeowners. By offering a centralized platform for managing your mortgage, RoundPoint ensures that you have the information and resources you need to stay informed and in control of your finances.

RoundPoint Mobile App Features

The RoundPoint mobile app is a powerful tool that allows homeowners to manage their mortgages on the go. With a range of features and a user-friendly interface, the app provides a convenient way to stay connected to your mortgage account.

Some of the key features of the RoundPoint mobile app include the ability to make payments, view your payment history, and check your outstanding balance. You can also set up automatic drafts, update your personal information, and access important documents, all from the convenience of your mobile device.

The RoundPoint mobile app is available for both iOS and Android devices, ensuring that homeowners can manage their mortgages anytime, anywhere. By offering a comprehensive mobile solution, RoundPoint provides the flexibility and convenience that modern homeowners demand.

Understanding Interest Rates and Fees

Interest rates and fees play a crucial role in determining the cost of your mortgage. RoundPoint Mortgage Pay provides clear and transparent information about these factors, helping homeowners make informed decisions about their loans.

Your mortgage interest rate is determined by a variety of factors, including your credit score, loan type, and market conditions. RoundPoint provides detailed information about how these factors affect your interest rate, helping you understand the true cost of your mortgage.

In addition to interest rates, RoundPoint also provides information about any fees associated with your mortgage. These fees can include origination fees, closing costs, and late payment penalties. By understanding these fees, homeowners can better manage their finances and avoid unexpected costs.

Tips for Efficient Mortgage Management

Managing your mortgage efficiently can save you time and money in the long run. RoundPoint Mortgage Pay offers a range of tips and strategies to help homeowners manage their mortgages more effectively.

One of the most important tips is to stay organized and keep track of your payments and financial obligations. By setting up a payment schedule and using RoundPoint's online tools, you can ensure that your payments are made on time and accurately.

Another key strategy is to take advantage of RoundPoint's resources and support. Their educational materials and customer service team can help you understand your mortgage and make informed decisions about your finances. By leveraging these resources, you can enhance your financial management skills and achieve your homeownership goals.

Common Issues and Solutions

While RoundPoint Mortgage Pay strives to provide a seamless payment experience, homeowners may occasionally encounter issues. Some common problems include payment discrepancies, account access issues, and misunderstandings about mortgage statements.

If you encounter a payment discrepancy, the first step is to review your mortgage statement and payment history. RoundPoint's customer service team is also available to help resolve any discrepancies and provide clarification about your account.

For account access issues, RoundPoint offers support through their website and mobile app. If you're having trouble logging in or accessing your account, their technical support team can help troubleshoot and resolve any issues.

Frequently Asked Questions

- How do I set up automatic payments with RoundPoint Mortgage Pay?

To set up automatic payments, log in to your RoundPoint account, navigate to the payment settings, and select the option for automatic bank drafts. Follow the prompts to enter your bank information and set your payment schedule.

- What should I do if I miss a mortgage payment?

If you miss a payment, contact RoundPoint's customer service immediately to discuss your options. They may be able to offer solutions such as payment extensions or modified payment plans.

- Can I make extra payments to pay off my mortgage faster?

Yes, RoundPoint allows homeowners to make additional payments toward their principal balance. Contact their customer service team to learn more about making extra payments and how it can affect your loan.

- How do I access my mortgage statements online?

You can access your mortgage statements by logging into your RoundPoint account and navigating to the documents section. Here, you'll find a history of your statements available for download.

- What should I do if I suspect fraudulent activity on my account?

If you suspect any unauthorized activity on your account, contact RoundPoint's customer service immediately. They will guide you through the process of securing your account and investigating the issue.

- How can I update my personal information with RoundPoint?

To update your personal information, log in to your RoundPoint account, navigate to the account settings, and make the necessary changes. Be sure to save your updates before exiting the page.

External Resources

For more information about managing your mortgage and understanding the mortgage industry, consider visiting the following external resources:

- Consumer Financial Protection Bureau - Offers resources and guidance on various financial topics, including mortgages.

- Mortgage Bankers Association - Provides insights and information on the mortgage industry.

Conclusion

RoundPoint Mortgage Pay offers a comprehensive and user-friendly solution for managing your mortgage payments. With a range of payment options, robust security measures, and exceptional customer support, RoundPoint ensures that homeowners have the tools and resources they need to manage their mortgages effectively.

By understanding the features and benefits of RoundPoint Mortgage Pay, you can make informed decisions about your mortgage and achieve your homeownership goals. Whether you are a first-time homeowner or an experienced property owner, RoundPoint is a reliable partner for your financial journey.

As you navigate the complexities of mortgage payments, remember that RoundPoint is here to support you every step of the way. With their commitment to transparency, security, and customer service, RoundPoint Mortgage Pay is a trusted ally in your financial success.

You Might Also Like

Career Opportunities At Cresco Labs: Your Path To SuccessTransforming Lives: The Impact Of Hedge Funds Care

Insights Into TheLayoff ExxonMobil: Navigating Corporate Challenges

Bishop Sedgwick Daniels Net Worth: A Financial Overview

Best Ways To Finance Your Unlocked IPhone 15 Pro Max

Article Recommendations

- Ron Palillo Net Worth 2024 A Deep Dive

- Georgias Rule Cast Meet The Stars

- Black Lab Pit Mix Lifespan Average Factors Affecting It