Welcome to our comprehensive guide on the RoundPoint Mortgage sign in process, your gateway to seamless mortgage management. Whether you're a new homeowner or a seasoned investor, understanding how to effectively navigate your mortgage account is crucial. With this guide, we aim to simplify your experience with RoundPoint Mortgage, ensuring you have all the information you need at your fingertips.

RoundPoint Mortgage is a leading mortgage servicing company that offers a range of services to homeowners across the United States. With their user-friendly online portal, managing your mortgage payments, checking account balances, and accessing important documents has never been easier. In this article, we delve into the step-by-step process of signing into your RoundPoint Mortgage account, along with additional tips and tricks to optimize your experience.

Our goal is to provide you with a detailed understanding of the RoundPoint Mortgage sign in process. From troubleshooting common issues to leveraging additional features, we've got you covered. As we explore the nuances of the RoundPoint system, you'll gain insights into maximizing the benefits of their online services, all while ensuring your personal information remains secure and protected.

Table of Contents

- Understanding RoundPoint Mortgage

- Navigating the RoundPoint Mortgage Portal

- How to Sign In to RoundPoint Mortgage

- Troubleshooting Sign In Issues

- Enhancing Account Security

- Managing Your Mortgage Account

- RoundPoint Mortgage Mobile Access

- Exploring Payment Options

- Accessing Important Documents

- Customer Support and Assistance

- Frequently Asked Questions

- Conclusion

Understanding RoundPoint Mortgage

RoundPoint Mortgage is a prominent mortgage servicer in the United States, known for its dedication to customer service and innovative solutions. As a subsidiary of a larger financial institution, RoundPoint provides a wide array of mortgage-related services, including loan origination, servicing, and management. Their focus on technology-driven solutions has made them a preferred choice for homeowners seeking convenience and efficiency in mortgage management.

At its core, RoundPoint Mortgage aims to simplify the complexities of mortgage servicing through its robust online platform. This platform allows users to handle various aspects of their mortgage, from making payments to accessing critical loan information. With a commitment to transparency and customer satisfaction, RoundPoint Mortgage continues to enhance its offerings, ensuring homeowners receive the support they need to manage their financial obligations effectively.

The Evolution of RoundPoint Mortgage

Since its inception, RoundPoint Mortgage has undergone significant transformations to meet the evolving needs of its clientele. Initially established as a traditional mortgage servicer, the company quickly embraced digital innovation, recognizing the growing demand for online services. This evolution has positioned RoundPoint as a leader in the mortgage industry, providing customers with seamless access to their accounts through a user-friendly online portal.

The company's dedication to technological advancement has not only improved the customer experience but has also streamlined internal operations. By investing in cutting-edge technology, RoundPoint Mortgage has been able to reduce processing times, enhance data security, and provide real-time updates to homeowners. These efforts underscore the company's commitment to excellence and its proactive approach to addressing the dynamic landscape of mortgage servicing.

Navigating the RoundPoint Mortgage Portal

The RoundPoint Mortgage portal serves as a centralized hub for homeowners to manage their mortgage accounts efficiently. Designed with user experience in mind, the portal offers a range of features that empower users to take control of their financial responsibilities. Whether you're looking to make a payment, review your account history, or update personal information, the portal provides a seamless interface for all your mortgage-related needs.

Key Features of the Portal

The RoundPoint Mortgage portal boasts a variety of features designed to simplify account management. Some of the key features include:

- Payment Management: Make one-time payments or set up automatic withdrawals to ensure timely mortgage payments.

- Account Overview: Access a comprehensive view of your mortgage account, including outstanding balances, payment history, and interest rates.

- Document Access: Retrieve important documents such as statements, loan agreements, and tax forms directly from the portal.

- Communication Tools: Utilize secure messaging to communicate with RoundPoint representatives regarding account inquiries and support requests.

User-Friendly Interface

The intuitive design of the RoundPoint Mortgage portal ensures that users can easily navigate through various sections without any hassle. With clear menus and straightforward navigation paths, even individuals with limited technical expertise can efficiently manage their accounts. The portal's responsive layout also ensures optimal performance across different devices, providing a seamless experience whether you're accessing it from a desktop, tablet, or smartphone.

How to Sign In to RoundPoint Mortgage

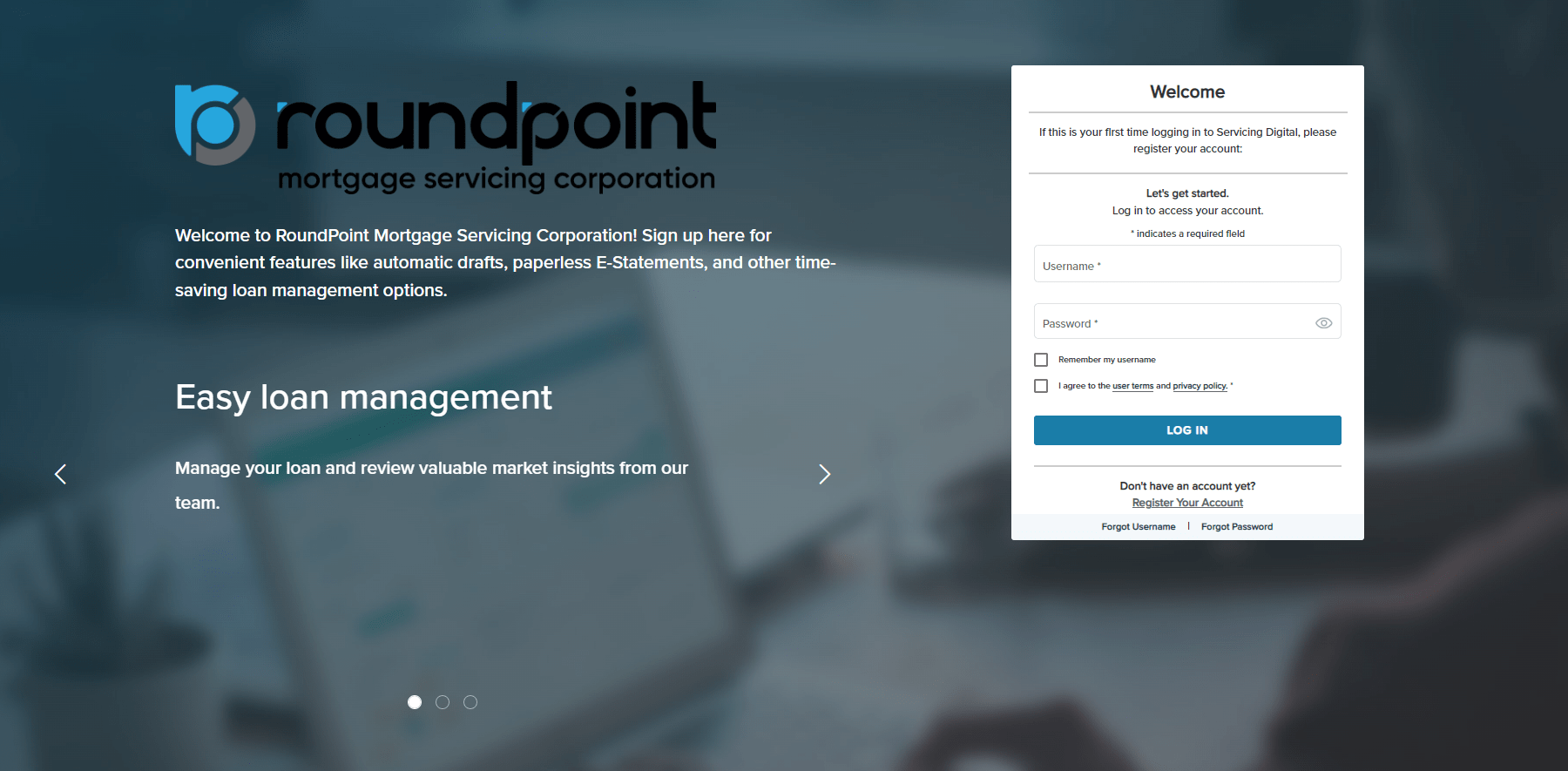

Accessing your RoundPoint Mortgage account is a straightforward process that requires just a few simple steps. Here's a step-by-step guide to help you sign in seamlessly:

Step-by-Step Sign In Process

- Visit the RoundPoint Mortgage Website: Open your preferred web browser and navigate to the official RoundPoint Mortgage website.

- Locate the Sign In Option: On the homepage, look for the "Sign In" button or link, typically found in the upper right corner of the page.

- Enter Your Credentials: Input your registered email address and password in the designated fields. Ensure that the information is accurate to avoid login errors.

- Verify Your Identity: Depending on your account settings, you may be required to complete additional security verification steps, such as entering a code sent to your registered email or phone number.

- Access Your Account: Once your identity is verified, you'll be granted access to your RoundPoint Mortgage account, where you can manage various aspects of your mortgage.

Troubleshooting Sign In Issues

While the RoundPoint Mortgage sign in process is generally smooth, users may occasionally encounter issues that prevent them from accessing their accounts. Here are some common problems and solutions to help you troubleshoot these issues:

Common Sign In Problems

Some of the typical challenges users face during the sign in process include:

- Forgotten Password: If you can't remember your password, use the "Forgot Password" link to reset it. Follow the prompts to receive a password reset email and create a new password.

- Incorrect Email or Password: Double-check your login credentials to ensure they are entered correctly. Pay attention to case sensitivity and any special characters.

- Account Lockout: After multiple failed login attempts, your account may be temporarily locked for security reasons. Wait a few minutes before trying again, or contact customer support for assistance.

Steps to Resolve Login Issues

To overcome any sign in issues, consider the following steps:

- Check Internet Connection: Ensure your device is connected to a stable internet connection to avoid disruptions during the login process.

- Clear Browser Cache: Clearing your browser's cache and cookies can help resolve login issues caused by stored data conflicts.

- Disable Browser Extensions: Some browser extensions may interfere with the login process. Temporarily disable them and try signing in again.

Enhancing Account Security

Securing your RoundPoint Mortgage account is of paramount importance to protect your sensitive information and prevent unauthorized access. Here are some strategies to enhance the security of your account:

Implementing Strong Passwords

Creating a strong password is the first line of defense against potential security threats. Follow these guidelines to ensure your password is robust:

- Length and Complexity: Use a combination of upper and lower case letters, numbers, and special characters. Aim for a password that is at least 12 characters long.

- Avoid Common Phrases: Refrain from using easily guessable phrases, such as "password123" or "qwerty."

- Unique Passwords: Avoid reusing passwords across multiple accounts to minimize the risk of a security breach.

Enabling Two-Factor Authentication (2FA)

Two-factor authentication adds an extra layer of security by requiring a second form of verification in addition to your password. Enable 2FA for your RoundPoint Mortgage account to enhance protection. This typically involves receiving a code via SMS or email that must be entered during the login process.

Managing Your Mortgage Account

Effectively managing your mortgage account is crucial for staying on top of your financial obligations and ensuring a smooth homeownership experience. The RoundPoint Mortgage portal provides a range of tools and features to help you manage your account efficiently.

Monitoring Account Activity

Regularly monitoring your account activity is essential for detecting any discrepancies or unauthorized transactions. The portal allows you to view detailed transaction history, payment records, and account statements, giving you a comprehensive overview of your mortgage activity.

Setting Up Automatic Payments

One of the most convenient features of the RoundPoint Mortgage portal is the ability to set up automatic payments. By enrolling in automatic payments, you can ensure that your mortgage payments are made on time every month, reducing the risk of late fees and maintaining a positive credit history.

RoundPoint Mortgage Mobile Access

In today's fast-paced world, having access to your mortgage account on the go is essential. RoundPoint Mortgage offers a mobile app that allows you to manage your account from your smartphone or tablet, providing convenience and flexibility.

Downloading and Using the Mobile App

To access your RoundPoint Mortgage account via the mobile app, follow these steps:

- Download the App: Visit the App Store (for iOS devices) or Google Play Store (for Android devices) and search for the RoundPoint Mortgage app. Download and install the app on your device.

- Log In to Your Account: Open the app and enter your RoundPoint Mortgage login credentials to access your account.

- Explore App Features: The mobile app offers various features, including payment management, account overview, and document access, similar to the web portal.

Exploring Payment Options

RoundPoint Mortgage provides several payment options to accommodate the diverse needs of homeowners. Understanding these options can help you choose the most convenient method for managing your mortgage payments.

Online Payments

The RoundPoint Mortgage portal allows you to make online payments quickly and securely. You can choose to make one-time payments or set up recurring payments to ensure your mortgage is paid on time each month. Online payments provide a hassle-free way to manage your financial responsibilities from the comfort of your home.

Mail Payments

If you prefer traditional payment methods, you can mail your mortgage payments to RoundPoint Mortgage. Be sure to include your account number on the check or money order to ensure proper processing. Keep in mind that mail payments may take longer to process, so plan accordingly to avoid late fees.

Accessing Important Documents

Accessing important mortgage documents is a key aspect of managing your account. The RoundPoint Mortgage portal provides easy access to a variety of documents, ensuring you have the information you need at your fingertips.

Types of Documents Available

Some of the essential documents you can access through the portal include:

- Monthly Statements: View and download your monthly mortgage statements for record-keeping and financial planning.

- Loan Agreements: Access copies of your loan agreements and terms to stay informed about your mortgage obligations.

- Tax Forms: Download tax-related documents, such as Form 1098, for use in your annual tax filings.

Retrieving Documents

To access documents on the RoundPoint Mortgage portal, log in to your account and navigate to the "Documents" section. From there, you can view and download the documents you need, ensuring you have all the necessary information for effective account management.

Customer Support and Assistance

RoundPoint Mortgage is committed to providing exceptional customer support to assist homeowners with their mortgage-related inquiries. Whether you have questions about your account, need technical assistance, or require guidance on mortgage options, RoundPoint's customer support team is ready to help.

Contacting Customer Support

To reach RoundPoint Mortgage's customer support, you can use the following methods:

- Phone: Call the RoundPoint Mortgage customer service hotline for immediate assistance with your inquiries.

- Email: Send an email to the customer support team for non-urgent inquiries or to request detailed information.

- Online Chat: Use the online chat feature on the RoundPoint Mortgage website for real-time support from a representative.

Frequently Asked Questions

Here are some common questions homeowners have about the RoundPoint Mortgage sign in process:

1. How do I reset my RoundPoint Mortgage password?

To reset your password, click on the "Forgot Password" link on the sign in page. Follow the prompts to receive a password reset email and create a new password.

2. What should I do if I'm locked out of my account?

If you're locked out of your account, wait a few minutes before trying to sign in again. If the issue persists, contact RoundPoint Mortgage customer support for assistance.

3. Can I access my RoundPoint Mortgage account from multiple devices?

Yes, you can access your account from multiple devices, including desktops, tablets, and smartphones. Ensure each device has a stable internet connection for optimal performance.

4. How can I enable two-factor authentication for my account?

To enable two-factor authentication, log in to your account, navigate to the security settings, and follow the instructions to set up 2FA using your preferred verification method.

5. What payment methods are available for my mortgage?

RoundPoint Mortgage offers several payment methods, including online payments, mail payments, and automatic withdrawals. Choose the option that best suits your needs for convenience and reliability.

6. How do I contact RoundPoint Mortgage customer support?

You can contact customer support via phone, email, or online chat. Visit the RoundPoint Mortgage website for detailed contact information and support hours.

Conclusion

Managing your mortgage account with RoundPoint Mortgage is a straightforward process, thanks to their user-friendly online portal and comprehensive support services. By understanding the sign in process, troubleshooting common issues, and leveraging available features, you can effectively manage your mortgage and ensure a seamless homeownership experience. With the insights and tips provided in this guide, you're well-equipped to navigate the complexities of mortgage management with confidence and ease.

For further information or additional assistance, don't hesitate to reach out to RoundPoint Mortgage's dedicated customer support team. Their commitment to exceptional service ensures that you have the resources and support needed to manage your mortgage effectively.

As you continue your journey with RoundPoint Mortgage, remember that staying informed and proactive in managing your mortgage will contribute to a positive and successful homeownership experience.

You Might Also Like

Empowering Financial Freedom: OAP Personal Loan SolutionsSecure And Personalized Private Chat Rooms For Effortless Communication

Ken Griffin's Yacht: Luxury Afloat

Mastering The Future Of Trading With LuckyTrader Robot

Breaking News Update: Avi Gilburt Recent Developments

Article Recommendations

- Stunning Pixie Cuts Wavy Hair Inspiration Ideas

- Expecting A Baby Ashantis Pregnancy Journey

- Black Lab Pit Mix Lifespan Average Factors Affecting It