In the rapidly evolving world of cryptocurrency, understanding the conversion of traditional currencies like USD to digital ones such as Litecoin (LTC) is essential. With the growing interest in cryptocurrencies, many individuals are seeking ways to diversify their portfolios. One common query is about converting 20 USD to LTC, a process that involves understanding the current exchange rates, market trends, and potential benefits of investing in Litecoin.

Litecoin, often referred to as the silver to Bitcoin's gold, has gained significant traction since its inception. It offers faster transaction times and a different hashing algorithm, making it a popular choice among crypto enthusiasts. By exploring the conversion of USD to LTC, one can gain insights into the practicalities of cryptocurrency investments, the risks involved, and the potential returns. This guide aims to provide a detailed analysis, offering readers a clear understanding of how to efficiently and effectively convert 20 USD to LTC.

As we delve into this topic, it's important to consider various factors such as transaction fees, market volatility, and the platforms available for conversion. By the end of this article, readers will have a thorough understanding of the conversion process, including the tools and resources required to make informed decisions. This guide serves as a valuable resource for anyone looking to explore the world of cryptocurrencies and make strategic investments.

Table of Contents

- Understanding Cryptocurrency Exchange Rates

- The History and Significance of Litecoin

- Why Invest in Litecoin?

- Steps to Convert 20 USD to LTC

- Choosing the Right Platform

- Analyzing Market Trends and Forecasts

- Understanding Transaction Fees

- Security and Safety Measures

- Maximizing Returns from Litecoin Investment

- Potential Risks and Challenges

- Case Studies and Real-Life Examples

- FAQs

- Conclusion

Understanding Cryptocurrency Exchange Rates

Cryptocurrency exchange rates are determined by the market's supply and demand dynamics. Unlike traditional currencies, which are influenced by government policies and economic indicators, cryptocurrencies are decentralized and their value is primarily driven by investor sentiment, technological advancements, and market speculation.

When converting USD to LTC, it's crucial to understand that the exchange rate is not fixed and can fluctuate rapidly. This volatility is both a risk and an opportunity for investors. To make informed decisions, it's essential to monitor the market regularly and use reliable sources for exchange rate information. Websites like CoinMarketCap and CryptoCompare provide real-time data and are widely used by investors to track cryptocurrency prices.

The History and Significance of Litecoin

Litecoin was created in 2011 by Charlie Lee, a former Google engineer, as a "lighter" version of Bitcoin. Its main goal was to address some of Bitcoin's limitations, particularly in terms of transaction speed and scalability. Litecoin achieved this by utilizing a different hashing algorithm called Scrypt, which allows for faster transaction confirmation times.

Over the years, Litecoin has established itself as one of the top cryptocurrencies in terms of market capitalization and user adoption. It is often used as a testing ground for new technologies that may later be implemented in Bitcoin, making it a significant player in the cryptocurrency space.

Why Invest in Litecoin?

Investing in Litecoin offers several advantages, making it an attractive option for both new and seasoned investors. Firstly, Litecoin's faster transaction times make it more suitable for everyday transactions compared to Bitcoin. Additionally, Litecoin has a robust and active community that continuously works on improving the network's features and security.

Furthermore, Litecoin's relative stability compared to other altcoins makes it a safer investment option. Its established track record and widespread acceptance also contribute to its appeal as a long-term investment. However, like all investments, it's important to conduct thorough research and assess your risk tolerance before investing in Litecoin.

Steps to Convert 20 USD to LTC

Converting 20 USD to LTC involves several steps, starting with choosing a reliable cryptocurrency exchange. Popular options include Coinbase, Binance, and Kraken, all of which offer user-friendly platforms for buying and selling cryptocurrencies.

Once you've selected an exchange, the next step is to create an account and complete the necessary verification process. This usually involves providing personal information and proof of identity. After your account is set up, you can deposit USD funds into your exchange wallet via bank transfer or credit card.

With funds in your wallet, you can proceed to purchase LTC. Most exchanges offer a straightforward interface where you can input the amount of USD you'd like to convert and execute the trade. It's important to note that the exchange rate at the time of conversion will determine how much LTC you'll receive for your 20 USD.

Choosing the Right Platform

Selecting the right platform for converting USD to LTC is crucial for ensuring a smooth and secure transaction. Factors to consider include the platform's reputation, user reviews, security features, and transaction fees.

It's advisable to choose a platform that offers robust security measures, such as two-factor authentication and cold storage for digital assets. Additionally, compare the transaction fees across different platforms, as these can significantly impact the overall cost of your conversion.

Analyzing Market Trends and Forecasts

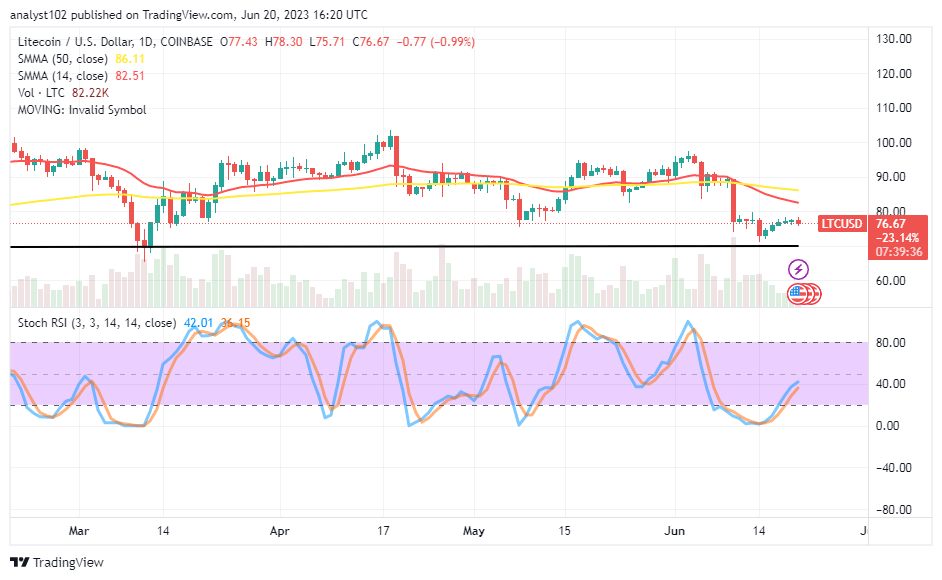

To make informed decisions when converting USD to LTC, it's essential to analyze market trends and forecasts. This involves studying historical price movements, understanding market cycles, and keeping up with news and developments in the cryptocurrency space.

Tools like technical analysis and sentiment analysis can help investors identify potential entry and exit points. By combining these insights with a thorough understanding of market dynamics, investors can better navigate the volatile cryptocurrency landscape.

Understanding Transaction Fees

Transaction fees are an important consideration when converting USD to LTC. These fees vary depending on the platform and network congestion at the time of the transaction. Most exchanges charge a percentage of the transaction amount as a fee, which can affect the total amount of LTC received.

To minimize transaction fees, consider using platforms with lower fee structures or conducting transactions during off-peak times when network congestion is lower. Additionally, some exchanges offer discounts on fees for users who hold their native tokens.

Security and Safety Measures

Ensuring the security of your cryptocurrency assets is paramount. When converting USD to LTC, it's important to use secure platforms and employ best practices for safeguarding your digital assets. This includes using strong, unique passwords and enabling two-factor authentication on all accounts.

Consider storing your LTC in a hardware wallet or other secure storage solutions that are less susceptible to online threats. Regularly update your security settings and stay informed about potential security risks in the cryptocurrency space.

Maximizing Returns from Litecoin Investment

To maximize returns from your Litecoin investment, it's important to implement a well-thought-out strategy. This may involve diversifying your portfolio, setting clear investment goals, and regularly reviewing your investment performance.

Consider taking advantage of market opportunities such as price dips to accumulate more LTC or using dollar-cost averaging to mitigate the impact of market volatility. By staying informed and proactive, you can enhance the potential returns from your Litecoin investment.

Potential Risks and Challenges

Investing in cryptocurrencies, including Litecoin, comes with inherent risks and challenges. These include market volatility, regulatory changes, and technological vulnerabilities. It's important to be aware of these risks and develop strategies to manage them effectively.

Stay informed about developments in the cryptocurrency space and be prepared to adapt your investment strategy as needed. Consider consulting with financial advisors or experts to gain additional insights and guidance.

Case Studies and Real-Life Examples

Examining case studies and real-life examples of individuals who have successfully converted USD to LTC can provide valuable insights. These examples can highlight common challenges, best practices, and lessons learned from real-world experiences.

By learning from others' experiences, you can gain a better understanding of the conversion process and apply these insights to your own investment strategy.

FAQs

- What is the current exchange rate for 20 USD to LTC? The exchange rate fluctuates based on market conditions. Check reliable sources like CoinMarketCap for the latest rates.

- Can I convert USD to LTC without using an exchange? Most conversions require the use of a cryptocurrency exchange for secure and efficient transactions.

- Are there any hidden fees when converting USD to LTC? It's important to review the platform's fee structure to understand all associated costs, including transaction and withdrawal fees.

- How long does it take to convert USD to LTC? The conversion process can vary depending on the platform and network congestion, but it typically takes a few minutes to complete.

- Is investing in Litecoin riskier than Bitcoin? Both cryptocurrencies carry risks due to market volatility, but Litecoin's faster transaction times and lower fees can offer advantages.

- What factors influence the price of Litecoin? Litecoin's price is influenced by market demand, technological developments, regulatory news, and broader economic factors.

Conclusion

Converting 20 USD to LTC is a process that requires careful consideration of various factors, including exchange rates, platform selection, and security measures. By understanding the intricacies of the cryptocurrency market and employing sound investment strategies, investors can make informed decisions and potentially benefit from the opportunities that Litecoin offers. As with any investment, it's important to stay informed, remain adaptable, and approach the market with a long-term perspective.

You Might Also Like

Convert 100 TRX To USD: A Comprehensive GuideStrategic Approaches To Investing In Apartment Complexes For Maximum Returns

Innovative Techniques: Microwave Weed For Quick And Safe Results

Top-Notch Innovations: Boston Based Fintechs Leading The Charge

Critical Insights Into Netscout Weaknesses: Impacts And Solutions

Article Recommendations

- Expecting A Baby Ashantis Pregnancy Journey

- Top Megan Fox Pics Unforgettable Looks

- Ron Palillo Net Worth 2024 A Deep Dive