In the world of investing, Exchange-Traded Funds (ETFs) have become a popular choice for many due to their diversification, liquidity, and cost-effectiveness. Among the vast array of ETFs available, QQQ and VTI are two that often draw the attention of investors. While both offer unique advantages, understanding their fundamental differences, performance metrics, risk factors, and suitability for various investment strategies is crucial for making informed decisions. This article delves into the nuances of QQQ vs VTI, providing a comprehensive comparison to guide you in selecting the best option for your investment portfolio.

QQQ, also known as the Invesco QQQ Trust, is an ETF that tracks the Nasdaq-100 Index, which comprises 100 of the largest non-financial companies listed on the Nasdaq Stock Market. This makes it heavily tilted towards the technology sector, featuring giants like Apple, Microsoft, and Amazon. On the other hand, VTI, or the Vanguard Total Stock Market ETF, aims to track the performance of the CRSP US Total Market Index, giving investors exposure to the entire U.S. stock market, including small, mid, and large-cap stocks across various sectors.

Both QQQ and VTI have their merits and appeal to different types of investors. While QQQ is known for its potential for high growth due to its focus on technology and innovation, VTI offers a more balanced and diversified approach, making it a safer bet for long-term investors seeking stability. In this article, we will explore the pros and cons of each ETF, the investment philosophy behind them, and how they can fit into different investment strategies. By the end, you'll have a clearer understanding of which ETF aligns best with your financial goals and risk tolerance.

Table of Contents

- Overview of QQQ

- Overview of VTI

- Key Differences Between QQQ and VTI

- Performance Analysis

- Risk and Volatility

- Dividend Yields and Income Potential

- Expense Ratios and Costs

- Investment Strategies

- Portfolio Diversification

- Potential Growth vs. Stability

- Suitability for Different Investors

- Tax Efficiency

- Historical Performance Comparison

- Future Outlook

- Frequently Asked Questions

- Conclusion

Overview of QQQ

QQQ, managed by Invesco, is one of the most well-known ETFs focusing on technology and innovation. It was established in 1999 and has since gained popularity for its exposure to the Nasdaq-100 Index. This index includes 100 of the largest non-financial companies listed on the Nasdaq Stock Market, with a significant portion of its holdings in the technology sector.

The technology-heavy nature of QQQ means that it includes some of the most influential companies in the world, such as Apple, Microsoft, Amazon, and Alphabet (Google). These companies are leaders in their respective fields, driving innovation and technological advancements. As a result, QQQ has the potential for high growth, but it also comes with higher volatility compared to more diversified ETFs.

One of the advantages of investing in QQQ is its high liquidity and ease of trading. It is one of the most actively traded ETFs, making it easy for investors to buy and sell shares without significantly impacting the market price. Additionally, QQQ offers a relatively low expense ratio, making it a cost-effective option for investors seeking exposure to the tech sector.

However, the concentration in technology also poses risks, particularly during market downturns when tech stocks tend to be more volatile. Investors should be aware of the potential for significant price swings and consider their risk tolerance when investing in QQQ.

Overview of VTI

VTI, the Vanguard Total Stock Market ETF, offers a broad and diversified exposure to the entire U.S. stock market. It seeks to track the performance of the CRSP US Total Market Index, covering small, mid, and large-cap stocks across various sectors. This makes VTI a popular choice for long-term investors looking for a balanced and comprehensive investment vehicle.

VTI's focus on diversification helps mitigate the risks associated with investing in individual sectors or companies. By holding a wide range of stocks, VTI provides investors with a more stable investment option, reducing the impact of market fluctuations on the overall portfolio. This diversification can be particularly beneficial during periods of economic uncertainty or market volatility.

Another advantage of VTI is its low expense ratio, which is one of the lowest in the industry. This cost-effectiveness makes VTI an attractive option for investors looking to minimize expenses while gaining exposure to the entire U.S. stock market. Additionally, VTI is known for its tax efficiency, making it a suitable choice for taxable accounts.

While VTI offers stability and diversification, it may not provide the same level of growth potential as more concentrated ETFs like QQQ. Investors looking for higher returns may need to consider the trade-off between growth and stability when choosing between VTI and other investment options.

Key Differences Between QQQ and VTI

When comparing QQQ vs VTI, several key differences emerge that can influence an investor's choice between the two. Understanding these differences is essential for aligning your investment strategy with your financial goals and risk tolerance.

Sector Concentration

One of the primary differences between QQQ and VTI is their sector concentration. QQQ is heavily weighted towards the technology sector, with over 50% of its holdings in tech companies. This concentration can lead to higher volatility and potential for greater returns, but it also increases exposure to sector-specific risks.

In contrast, VTI offers a more diversified approach, covering all sectors of the U.S. economy. This diversification reduces the impact of any single sector on the overall performance of the ETF, providing a more stable investment option.

Index Composition

QQQ tracks the Nasdaq-100 Index, which includes 100 of the largest non-financial companies listed on the Nasdaq Stock Market. This index is known for its focus on technology and innovation, with a significant portion of its holdings in high-growth tech companies.

VTI, on the other hand, tracks the CRSP US Total Market Index, which includes thousands of stocks across small, mid, and large-cap companies. This index provides a comprehensive view of the entire U.S. stock market, offering investors a balanced and diversified portfolio.

Risk and Volatility

Due to its concentration in technology stocks, QQQ tends to be more volatile than VTI. Tech stocks can experience significant price swings, particularly during periods of market uncertainty or economic downturns. Investors in QQQ should be prepared for this volatility and consider their risk tolerance before investing.

VTI's diversified approach helps mitigate these risks by spreading investments across various sectors and companies. This diversification results in lower volatility and provides a more stable investment option for risk-averse investors.

Growth Potential

QQQ's focus on technology and innovation provides the potential for high growth, as tech companies are often at the forefront of new developments and advancements. This growth potential can be attractive for investors seeking higher returns, but it also comes with increased risk.

While VTI may not offer the same level of growth potential as QQQ, its diversified approach provides a more balanced investment option. This balance can be beneficial for investors looking for stability and consistent returns over the long term.

Overall, the choice between QQQ and VTI depends on an investor's financial goals, risk tolerance, and investment strategy. Both ETFs offer unique advantages, and understanding their differences is crucial for making informed investment decisions.

Performance Analysis

Analyzing the performance of QQQ vs VTI provides valuable insights into their potential returns and risk profiles. While past performance is not indicative of future results, it can help investors understand the historical trends and factors that have influenced the performance of these ETFs.

Historical Performance

Historically, QQQ has outperformed VTI due to its focus on high-growth technology stocks. The tech sector has experienced significant growth over the past decade, driven by advancements in technology and innovation. As a result, QQQ has delivered impressive returns, attracting investors seeking higher growth potential.

However, this outperformance comes with increased volatility. QQQ is subject to larger price swings, particularly during market downturns or periods of economic uncertainty. Investors in QQQ should be prepared for this volatility and consider their risk tolerance before investing.

VTI, on the other hand, provides a more stable and consistent performance due to its diversified approach. While it may not deliver the same level of growth as QQQ, its balanced portfolio helps mitigate risks and provides a more stable investment option for risk-averse investors.

Recent Trends

In recent years, the performance of QQQ and VTI has been influenced by several factors, including changes in market conditions, economic policies, and technological advancements. The COVID-19 pandemic, for example, has accelerated the adoption of technology, benefiting tech-heavy ETFs like QQQ.

However, the pandemic has also highlighted the importance of diversification, as different sectors have experienced varying levels of impact. VTI's diversified approach has helped it weather market fluctuations and provide consistent returns during these uncertain times.

Comparative Returns

When comparing the returns of QQQ vs VTI, it's important to consider the time horizon and investment goals. QQQ's focus on technology provides the potential for higher returns over the short term, but it also comes with increased risk and volatility.

VTI, with its diversified approach, offers more stable and consistent returns over the long term. This stability can be beneficial for investors seeking a balanced investment option and willing to accept lower returns in exchange for reduced risk.

Overall, the performance of QQQ vs VTI depends on an investor's financial goals, risk tolerance, and investment strategy. Both ETFs offer unique advantages, and understanding their performance is crucial for making informed investment decisions.

Risk and Volatility

Understanding the risk and volatility of QQQ vs VTI is essential for investors when making informed decisions. Risk refers to the potential for loss, while volatility measures the degree of price fluctuations over time. Both factors play a significant role in determining the suitability of an ETF for different investment strategies and risk profiles.

QQQ Risk Factors

QQQ's heavy concentration in technology stocks makes it more susceptible to sector-specific risks. The tech sector is known for its rapid pace of innovation, but it also faces challenges such as regulatory changes, cybersecurity threats, and market competition. These factors can lead to significant price swings and increased volatility for QQQ.

Additionally, QQQ is more sensitive to changes in interest rates and economic conditions. During periods of economic uncertainty or market downturns, tech stocks tend to be more volatile, impacting the overall performance of QQQ. Investors in QQQ should be prepared for these risks and consider their risk tolerance before investing.

VTI Risk Factors

VTI's diversified approach helps mitigate sector-specific risks by spreading investments across various sectors and companies. This diversification reduces the impact of any single sector on the overall performance of the ETF, providing a more stable investment option.

However, VTI is not immune to market risks. Economic downturns, geopolitical events, and changes in interest rates can impact the overall stock market, affecting the performance of VTI. While VTI offers lower volatility compared to QQQ, investors should still be aware of these risks and consider their risk tolerance when investing.

Volatility Comparison

When comparing the volatility of QQQ vs VTI, QQQ tends to be more volatile due to its concentration in technology stocks. Tech stocks can experience significant price swings, particularly during periods of market uncertainty or economic downturns. Investors in QQQ should be prepared for this volatility and consider their risk tolerance before investing.

VTI's diversified approach results in lower volatility, providing a more stable investment option for risk-averse investors. This stability can be beneficial for investors seeking consistent returns and willing to accept lower returns in exchange for reduced risk.

Overall, the risk and volatility of QQQ vs VTI depend on an investor's financial goals, risk tolerance, and investment strategy. Both ETFs offer unique advantages, and understanding their risk profiles is crucial for making informed investment decisions.

Dividend Yields and Income Potential

When evaluating QQQ vs VTI, understanding their dividend yields and income potential is essential for investors seeking regular income from their investments. Dividend yield refers to the annual dividend payment as a percentage of the ETF's share price, while income potential considers the overall ability of the ETF to generate income through dividends.

QQQ Dividend Yield

QQQ's focus on high-growth technology stocks means that its dividend yield is generally lower compared to more diversified ETFs like VTI. Tech companies often reinvest their earnings into research and development, prioritizing growth over dividend payments. As a result, QQQ may not be the best choice for income-focused investors seeking regular dividend payments.

VTI Dividend Yield

VTI, with its diversified approach, offers a higher dividend yield compared to QQQ. By investing in a wide range of sectors and companies, VTI provides a more balanced income potential, making it an attractive option for investors seeking regular income from their investments. Additionally, VTI's focus on stability and consistent returns enhances its appeal to income-focused investors.

Income Potential Comparison

When comparing the income potential of QQQ vs VTI, it's important to consider the investment goals and risk tolerance of the investor. QQQ's focus on technology and growth may not deliver the same level of income as VTI, but it offers higher growth potential for investors willing to accept increased risk.

VTI, with its diversified approach, provides a more stable and consistent income potential, making it a suitable choice for income-focused investors seeking regular dividend payments. This stability can be beneficial for investors seeking a balanced investment option and willing to accept lower growth potential in exchange for regular income.

Overall, the dividend yields and income potential of QQQ vs VTI depend on an investor's financial goals, risk tolerance, and investment strategy. Both ETFs offer unique advantages, and understanding their income potential is crucial for making informed investment decisions.

Expense Ratios and Costs

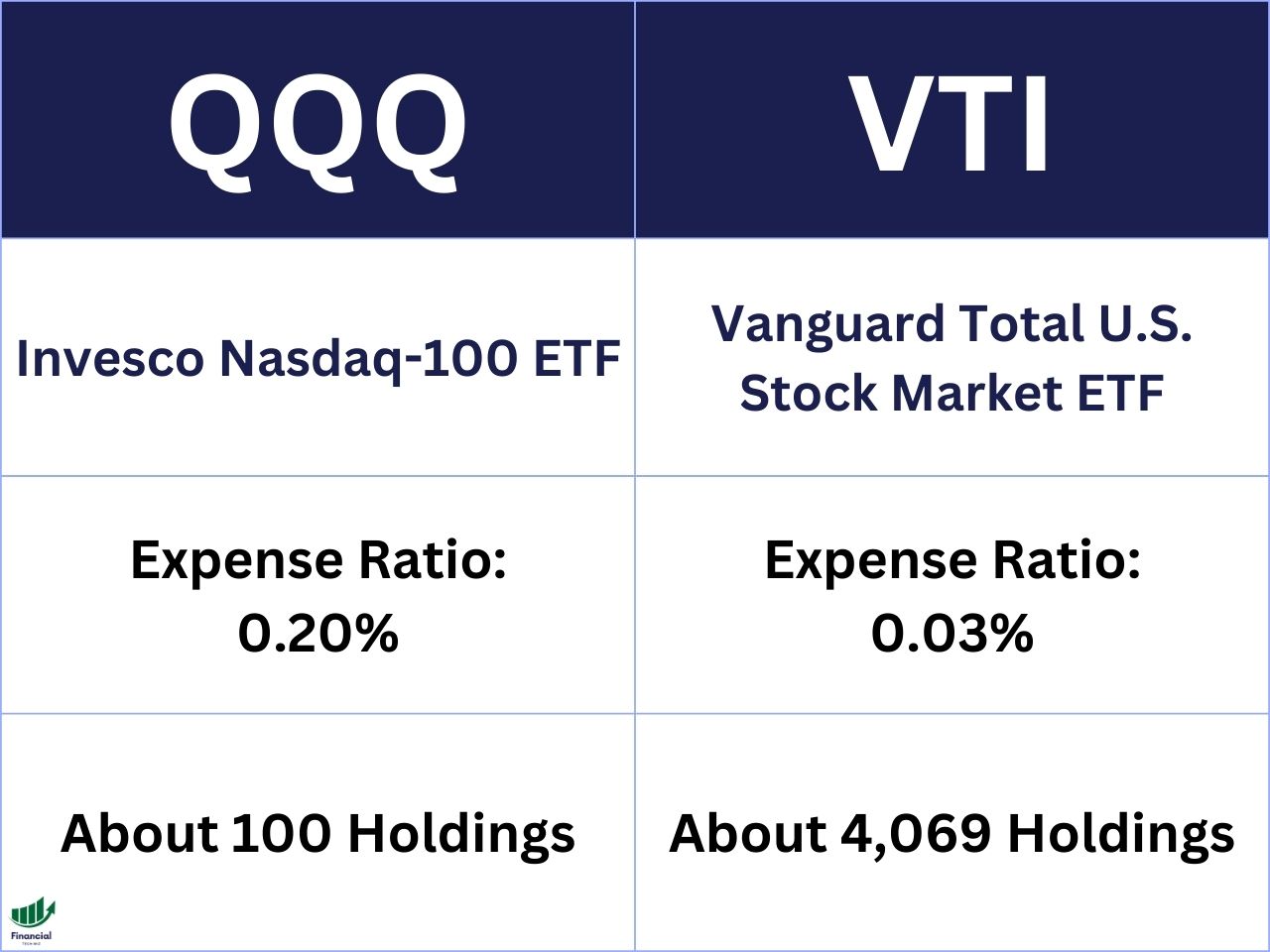

When considering QQQ vs VTI, evaluating their expense ratios and associated costs is crucial for investors. The expense ratio represents the annual fee charged by the ETF provider as a percentage of the fund's assets, covering management fees, administrative costs, and other expenses. Lower expense ratios are generally preferred, as they leave more money for potential returns.

QQQ Expense Ratio

QQQ has a relatively low expense ratio, making it a cost-effective option for investors seeking exposure to the technology sector. The competitive fee structure of QQQ contributes to its popularity among investors looking to minimize costs while gaining access to high-growth tech stocks.

VTI Expense Ratio

VTI boasts one of the lowest expense ratios in the industry, which is a significant advantage for cost-conscious investors. Vanguard's commitment to low-cost investing has made VTI an attractive option for those seeking diversified exposure to the entire U.S. stock market without incurring high fees.

Cost Comparison

When comparing the costs of QQQ vs VTI, it's essential to consider the overall investment strategy and goals. While both ETFs offer low expense ratios, VTI's fee structure is particularly advantageous for long-term investors seeking to minimize costs over time.

The low expense ratio of VTI enhances its appeal for investors looking for diversified exposure to the U.S. stock market, while QQQ's competitive fees make it a viable choice for those seeking targeted exposure to the technology sector.

Overall, the expense ratios and costs of QQQ vs VTI depend on an investor's financial goals, risk tolerance, and investment strategy. Both ETFs offer unique advantages, and understanding their cost structures is crucial for making informed investment decisions.

Investment Strategies

When evaluating QQQ vs VTI, understanding their suitability for different investment strategies is vital for investors. Both ETFs offer unique advantages, and the choice between them depends on an investor's financial goals, risk tolerance, and overall investment strategy.

Growth-Oriented Strategy

For investors seeking higher growth potential, QQQ may be a suitable choice due to its focus on technology and innovation. The tech sector is known for its rapid pace of advancements, offering the potential for significant returns. However, this growth potential comes with increased risk and volatility, and investors should be prepared for price fluctuations.

Diversification Strategy

Investors seeking a diversified approach may find VTI more aligned with their goals. VTI offers broad exposure to the entire U.S. stock market, covering various sectors and companies. This diversification helps mitigate risks and provides a more stable investment option, making it suitable for risk-averse investors.

Income-Focused Strategy

For income-focused investors seeking regular dividend payments, VTI may be a more suitable choice due to its higher dividend yield compared to QQQ. VTI's diversified approach provides a balanced income potential, making it an attractive option for those seeking regular income from their investments.

Long-Term Strategy

Investors with a long-term investment horizon may benefit from VTI's consistent returns and stability. VTI's focus on diversification and low expense ratio enhances its appeal for long-term investors seeking a balanced and cost-effective investment option.

Overall, the investment strategies for QQQ vs VTI depend on an investor's financial goals, risk tolerance, and overall investment strategy. Both ETFs offer unique advantages, and understanding their suitability for different strategies is crucial for making informed investment decisions.

Portfolio Diversification

When considering QQQ vs VTI, understanding their role in portfolio diversification is essential for investors. Diversification is a key component of risk management, and both ETFs offer unique advantages in enhancing a diversified investment portfolio.

QQQ's Role in Diversification

QQQ's focus on technology and innovation makes it a valuable addition to portfolios seeking exposure to high-growth sectors. While it offers the potential for significant returns, its concentration in tech stocks requires careful consideration of risk tolerance and sector-specific risks.

Investors can use QQQ to complement a diversified portfolio by adding exposure to the tech sector, enhancing growth potential while balancing risk with other asset classes.

VTI's Role in Diversification

VTI's comprehensive exposure to the entire U.S. stock market makes it an ideal core holding for diversified portfolios. With investments spanning various sectors and companies, VTI provides stability and consistent returns, reducing the impact of market fluctuations.

As a core holding, VTI can anchor a diversified portfolio, providing a solid foundation for investors seeking a balanced and comprehensive investment strategy.

Combining QQQ and VTI

Investors seeking to maximize diversification may consider combining QQQ and VTI in their portfolios. By incorporating both ETFs, investors can benefit from QQQ's growth potential in the tech sector while leveraging VTI's stability and diversification.

This combination allows investors to tailor their portfolios to their financial goals and risk tolerance, achieving a balance between growth and stability.

Overall, the role of QQQ vs VTI in portfolio diversification depends on an investor's financial goals, risk tolerance, and overall investment strategy. Both ETFs offer unique advantages, and understanding their role in diversification is crucial for making informed investment decisions.

Potential Growth vs. Stability

When evaluating QQQ vs VTI, understanding the trade-off between potential growth and stability is essential for investors. Both ETFs offer unique advantages, and the choice between them depends on an investor's financial goals, risk tolerance, and overall investment strategy.

QQQ's Growth Potential

QQQ's focus on technology and innovation provides the potential for high growth, as tech companies are often at the forefront of new developments and advancements. This growth potential can be attractive for investors seeking higher returns, but it also comes with increased risk and volatility.

VTI's Stability

VTI offers a more balanced and diversified approach, providing stability and consistent returns. Its comprehensive exposure to the entire U.S. stock market helps mitigate risks and reduce the impact of market fluctuations, making it suitable for risk-averse investors seeking stability.

Balancing Growth and Stability

Investors seeking to balance growth and stability may consider incorporating both QQQ and VTI in their portfolios. By combining these ETFs, investors can achieve a balance between the growth potential of the tech sector and the stability of a diversified portfolio.

This approach allows investors to tailor their portfolios to their financial goals and risk tolerance, achieving a balance between growth and stability.

Overall, the potential growth vs. stability of QQQ vs VTI depends on an investor's financial goals, risk tolerance, and overall investment strategy. Both ETFs offer unique advantages, and understanding the trade-off between growth and stability is crucial for making informed investment decisions.

Suitability for Different Investors

When evaluating QQQ vs VTI, understanding their suitability for different types of investors is essential for making informed investment decisions. Both ETFs offer unique advantages, and the choice between them depends on an investor's financial goals, risk tolerance, and overall investment strategy.

Growth-Oriented Investors

For investors seeking higher growth potential, QQQ may be a suitable choice due to its focus on technology and innovation. The tech sector is known for its rapid pace of advancements, offering the potential for significant returns. However, this growth potential comes with increased risk and volatility, and investors should be prepared for price fluctuations.

Risk-Averse Investors

Investors seeking stability and consistent returns may find VTI more aligned with their goals. VTI's diversified approach provides broad exposure to the entire U.S. stock market, reducing the impact of market fluctuations and offering a more stable investment option.

Income-Focused Investors

For income-focused investors seeking regular dividend payments, VTI may be a more suitable choice due to its higher dividend yield compared to QQQ. VTI's diversified approach provides a balanced income potential, making it an attractive option for those seeking regular income from their investments.

Long-Term Investors

Investors with a long-term investment horizon may benefit from VTI's consistent returns and stability. VTI's focus on diversification and low expense ratio enhances its appeal for long-term investors seeking a balanced and cost-effective investment option.

Overall, the suitability of QQQ vs VTI for different investors depends on an investor's financial goals, risk tolerance, and overall investment strategy. Both ETFs offer unique advantages, and understanding their suitability for different investors is crucial for making informed investment decisions.

Tax Efficiency

When evaluating QQQ vs VTI, understanding their tax efficiency is essential for investors seeking to minimize tax liabilities. Tax efficiency refers to the ability of an investment to generate returns while minimizing the impact of taxes on those returns.

QQQ Tax Efficiency

QQQ's focus on technology stocks means that it may experience higher turnover, leading to increased capital gains distributions. These distributions can generate tax liabilities for investors in taxable accounts. However, QQQ's low expense ratio helps offset some of these tax implications, making it a relatively tax-efficient option for tech-focused investors.

VTI Tax Efficiency

VTI is known for its tax efficiency due to its low turnover and broad diversification. By investing in a wide range of sectors and companies, VTI minimizes capital gains distributions, reducing the impact of taxes on returns. This tax efficiency makes VTI an attractive option for investors in taxable accounts.

Tax Considerations

When considering the tax efficiency of QQQ vs VTI, investors should take into account their individual tax situations and investment goals. While both ETFs offer unique advantages, VTI's tax efficiency may be more beneficial for investors in taxable accounts seeking to minimize tax liabilities.

Overall, the tax efficiency of QQQ vs VTI depends on an investor's financial goals, risk tolerance, and overall investment strategy. Both ETFs offer unique advantages, and understanding their tax implications is crucial for making informed investment decisions.

Historical Performance Comparison

Analyzing the historical performance of QQQ vs VTI provides valuable insights into their potential returns and risk profiles. While past performance is not indicative of future results, it can help investors understand the historical trends and factors that have influenced the performance of these ETFs.

QQQ Historical Performance

Historically, QQQ has outperformed VTI due to its focus on high-growth technology stocks. The tech sector has experienced significant growth over the past decade, driven by advancements in technology and innovation. As a result, QQQ has delivered impressive returns, attracting investors seeking higher growth potential.

However, this outperformance comes with increased volatility. QQQ is subject to larger price swings, particularly during market downturns or periods of economic uncertainty. Investors in QQQ should be prepared for this volatility and consider their risk tolerance before investing.

VTI Historical Performance

VTI, on the other hand, provides a more stable and consistent performance due to its diversified approach. While it may not deliver the same level of growth as QQQ, its balanced portfolio helps mitigate risks and provides a more stable investment option for risk-averse investors.

Comparative Analysis

When comparing the historical performance of QQQ vs VTI, it's important to consider the time horizon and investment goals. QQQ's focus on technology provides the potential for higher returns over the short term, but it also comes with increased risk and volatility.

VTI, with its diversified approach, offers more stable and consistent returns over the long term. This stability can be beneficial for investors seeking a balanced investment option and willing to accept lower returns in exchange for reduced risk.

Overall, the historical performance of QQQ vs VTI depends on an investor's financial goals, risk tolerance, and investment strategy. Both ETFs offer unique advantages, and understanding their historical performance is crucial for making informed investment decisions.

Future Outlook

When evaluating QQQ vs VTI, understanding their future outlook is essential for investors seeking to align their investment strategies with potential market trends and opportunities. Both ETFs offer unique advantages, and the future outlook depends on various factors that may influence their performance.

QQQ Future Outlook

QQQ's focus on technology and innovation positions it well for future growth, as tech companies continue to drive advancements and shape the global economy. The increasing adoption of technology across various industries, coupled with the rise of new technologies such as artificial intelligence and 5G, presents significant growth opportunities for QQQ.

However, the tech sector also faces challenges, including regulatory scrutiny, cybersecurity threats, and market competition. These factors may impact the future performance of QQQ, and investors should be prepared for potential volatility.

VTI Future Outlook

VTI's diversified approach provides stability and consistent returns, making it well-suited for investors seeking a balanced investment option. The broad exposure to the entire U.S. stock market helps mitigate risks and reduce the impact of market fluctuations, positioning VTI for steady growth over the long term.

As the global economy continues to recover from the COVID-19 pandemic, VTI's diversified approach may benefit from the resurgence of various sectors and companies, enhancing its appeal to risk-averse investors.

Market Trends and Opportunities

The future outlook for QQQ vs VTI depends on various market trends and opportunities, including changes in technology, economic policies, and global events. Investors should consider these factors when aligning their investment strategies with potential market trends and opportunities.

Overall, the future outlook for QQQ vs VTI depends on an investor's financial goals, risk tolerance, and overall investment strategy. Both ETFs offer unique advantages, and understanding their future outlook is crucial for making informed investment decisions.

Frequently Asked Questions

What are QQQ and VTI?

QQQ is the Invesco QQQ Trust, an ETF that tracks the Nasdaq-100 Index, focusing on technology and innovation. VTI is the Vanguard Total Stock Market ETF, offering broad exposure to the entire U.S. stock market, covering various sectors and companies.

Which ETF has a higher dividend yield, QQQ or VTI?

VTI generally offers a higher dividend yield compared to QQQ due to its diversified approach and focus on stability. QQQ's focus on high-growth technology stocks often results in lower dividend payouts.

Is QQQ more volatile than VTI?

Yes, QQQ tends to be more volatile than VTI due to its concentration in technology stocks. The tech sector is known for its rapid pace of innovation and significant price swings, leading to increased volatility for QQQ.

Which ETF is more suitable for long-term investors?

VTI is often more suitable for long-term investors due to its diversified approach, providing stability and consistent returns. Its low expense ratio and tax efficiency also enhance its appeal for long-term investment strategies.

Can I hold both QQQ and VTI in my portfolio?

Yes, investors can hold both QQQ and VTI in their portfolios to achieve a balance between growth and stability. This combination allows investors to benefit from QQQ's growth potential in the tech sector while leveraging VTI's diversification and stability.

How do expense ratios compare between QQQ and VTI?

Both QQQ and VTI offer low expense ratios, making them cost-effective investment options. However, VTI's expense ratio is generally lower, enhancing its appeal for long-term investors seeking to minimize costs over time.

Conclusion

In conclusion, the choice between QQQ vs VTI depends on an investor's financial goals, risk tolerance, and overall investment strategy. Both ETFs offer unique advantages, with QQQ providing high growth potential in the tech sector and VTI offering stability and diversification across the entire U.S. stock market.

Investors should carefully consider their individual investment objectives and risk profiles when deciding between QQQ and VTI. By understanding the key differences, performance metrics, and risk factors associated with each ETF, investors can make informed decisions that align with their financial goals and long-term investment strategies.

Ultimately, both QQQ and VTI can play valuable roles in a diversified investment portfolio, offering opportunities for growth and stability. By leveraging the unique strengths of each ETF, investors can tailor their portfolios to achieve a balance between potential returns and risk management.

For further information and detailed analysis on ETFs, investors can explore resources such as the Investopedia ETF Guide, which provides comprehensive insights into the world of ETFs and their role in investment portfolios.

You Might Also Like

In-Depth Guide To Www. Bitnation-blog.com: Your Ultimate ResourceInvestment Choices: VUG Vs VTI For Long-Term Growth

Insights Into The Life And Career Of Gary S Guthart: A Trailblazer In Robotics

Top Benefits Of Using Pionex United States For Cryptocurrency Trading

Mastering Dividends IVR: A Guide To Financial Success

Article Recommendations

- Top Megan Fox Pics Unforgettable Looks

- Stunning Pixie Cuts Wavy Hair Inspiration Ideas

- Sylvester Stallones 80s Iconic Action Rocky Returns